Weather is clearly the factor for the weak prices, as favorable conditions in Brazil, Vietnam, Columbia all transpire to yield a bumper crop.

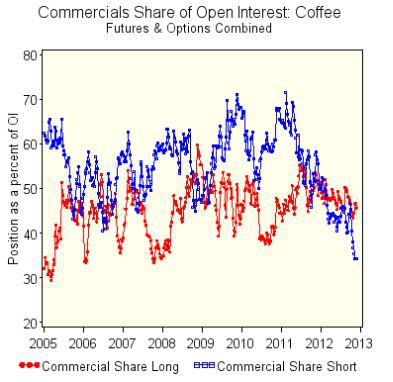

What is interesting is the Commitment of Traders report from this Friday. The Commercials (the smart money we will call them) have continued to reduce their short exposure. As seen in the chart below, the ratio of short to total open interest for coffee futures and options is at its lowest point since 2006 (the blue dotted line).

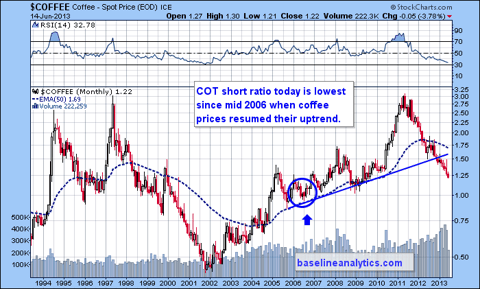

Note the coffee weekly chart below. When the COT ratio was at its mid-2006 low, coffee prices began to recover and resume their uptrend.

Based on the COT report and the slaughter that JO has been through since its peak in the Spring of 2011, it may be worth speculating on a price recovery of this commodity.

Visit Baseline Analytics for insightful investment opportunities.

No comments:

Post a Comment