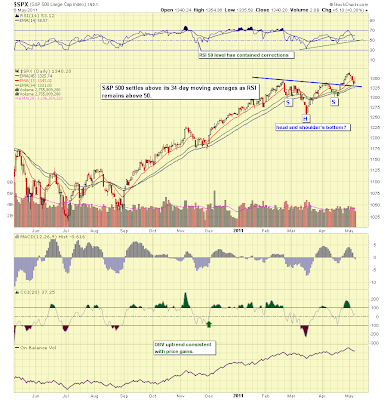

Enough short-term damage has been done to equities to instill a "wait-and-see" attitude toward either short or long positions. Seemingly good economic and political news events are not sending equities decisively higher (a bearish development). Looking at the chart of the S&P500, it appears that last week's swoon has met the conditions of a reasonable correction in an uptrend. However, with the decline off the opening highs on Friday, and a newly-negative MACD (printed below the price chart), we are at a standstill between the bulls and the bears:

Gauging our various indicators, major indices held support and rested just above their RSI 50 lines. However, as we have noted here in the past, the reversal in our corporate vs. government bond ratio (LQD/IEF), and weakness in copper prices, foretell concerns about a softer economic recovery:

Copper/US Gov't Bond ratio breaks trendline support:

Corporate vs. Medium-Term Government Bond Ratio favors bonds over stocks:

Historically, these two indicators cited above have led market turns in the equity markets. For now, we will heed their advice and remain cautious unless and until a convincing rally in equities (on higher volume, imagine that!) and a reversal in these two indicators occurs.

Click here for the latest Market Tour on StockCharts.com.

Chart Pattern Indicator: What's the Reading?

1 week ago

No comments:

Post a Comment